We are halfway through May. This is how the numbers stack up versus the exact time last year.

Larimer County:

- Inventory up 26%

- Closings down 4%

- Average Prices up 13%

Weld County:

- Inventory up 18%

- Closings up 6%

- Average Prices down 5%

Welcome to 2719 Claremont Dr, a cozy 4-bedroom, 2-bathroom gem nestled in the heart of Fort Collins, CO. With 1,643 square feet of living space, this home offers a fantastic opportunity to create your dream home in a highly desirable location. As you step inside, you’ll find a spacious layout with plenty of natural light. The front living room provides a welcoming space for entertaining and relaxing, whichever brings you joy. The kitchen and dining area feature stainless steel appliances and ample counter space that every home cook will love. The four bedrooms offer plenty of space for all of your needs. Outside, the property boasts a generous yard, perfect for gardening, play, or relaxation. This classic tri-level home is just waiting for you to put your personal touches on it! Located in the Cedar Village neighborhood, 2719 Claremont Dr is close to schools, parks, shopping, and dining options. Minutes from Horsetooth Reservoir and Old Town Fort Collins, this home is in the perfect location, no matter what your passions are! Enjoy the vibrant community and the beautiful Colorado outdoors with ease. Call (719) 310-9336 to schedule a private tour or click here for more information.

We are halfway through May. This is how the numbers stack up versus the exact time last year.

Larimer County:

Weld County:

Come check out 805 Summer Hawk Dr J59! Conveniently located near shopping and recreation areas and minutes from I-25, you have everything you need nearby! On the main floor you’ll find a spacious living area with a gas fireplace and large window to let in all the Colorado sunshine. The dining area is located next to the kitchen which has ample cabinet space for storage. Upstairs both bedrooms have their own private bathrooms and the primary bedroom features a walk-in closet. The unfinished basement offers lots of opportunity to expand with an additional bedroom or rec room. The community features walking paths, a playground area, and green spaces. Call (719) 310-9336 to schedule a private tour or click here for more information.

Welcome to 3348 Green Lake Dr #2! This 2-story townhome is situated on the north east side of Fort Collins, conveniently located near I-25 and less than 15 minutes to Old Town, grocery shopping, and entertainment. Built in 2019, this home still feels new! Large south facing windows in the living room allow the Colorado sunshine to brighten your home all day. On the main floor you’ll find an open concept with a living room, dining area, and kitchen that features stainless steel appliances, grey granite counters, grey tile backsplash, and white cabinets. A powder bath and closet for storage finish out the space. Upstairs are the 3 bedrooms, 2 spare and one primary. One of the spare bedrooms features luxury vinyl plank flooring and the other two are carpeted. There is a 3/4 bathroom in the primary bedroom which features a large walk-in shower and dual vanity with lots of cabinet space for storage. A walk-in closet in the primary bedroom offers lots of space for storage and clothes. The community includes a playground and small bike track and isn’t far from the Poudre Trail or the Poudre Whitewater Park. The seller is offering $7,500 for a buyer to use for a rate buy-down or help with closing costs. Call (719) 310-9336 to schedule a private tour or click here for more information.

Windermere Chief Economist Matthew Gardner demonstrates how the U.S. housing market is adapting to low inventory levels. He touches on the new construction industry, supply changes in large metro areas, median home sale prices, and more.

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Hello there, I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew. As we are all aware, the housing market has softened considerably with the number of existing homes available to buy close to record lows. Today we are going to talk about supply, and how the market is starting to adapt to low inventory levels.

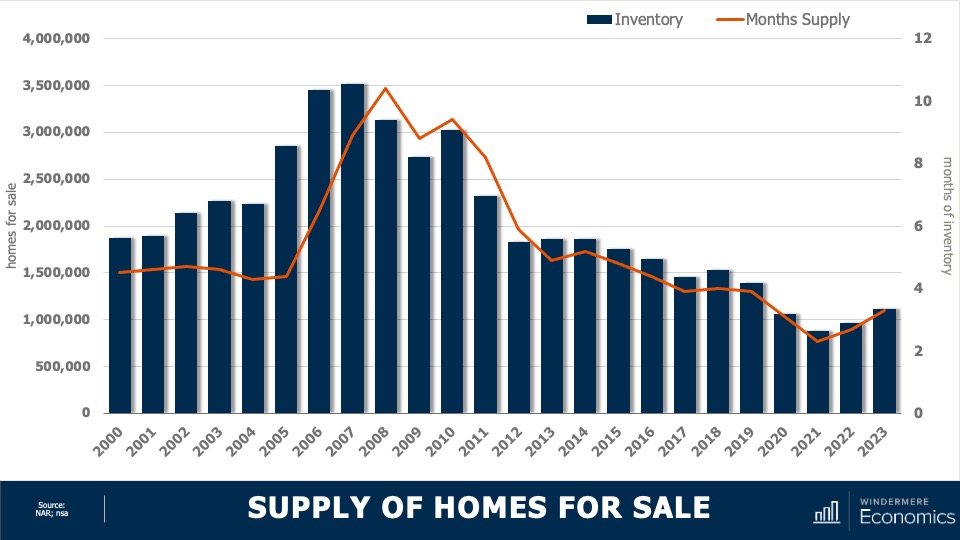

This chart shows the average number of homes on the market by year. Although year to date we have seen a little bit of an uptick, it’s clear the country remains supply-starved. And with just over three months of inventory—as opposed to the normal four to six—the market is clearly out of balance. But even though inventory levels have risen nationally, as I’ve said many times before, not all markets are equal.

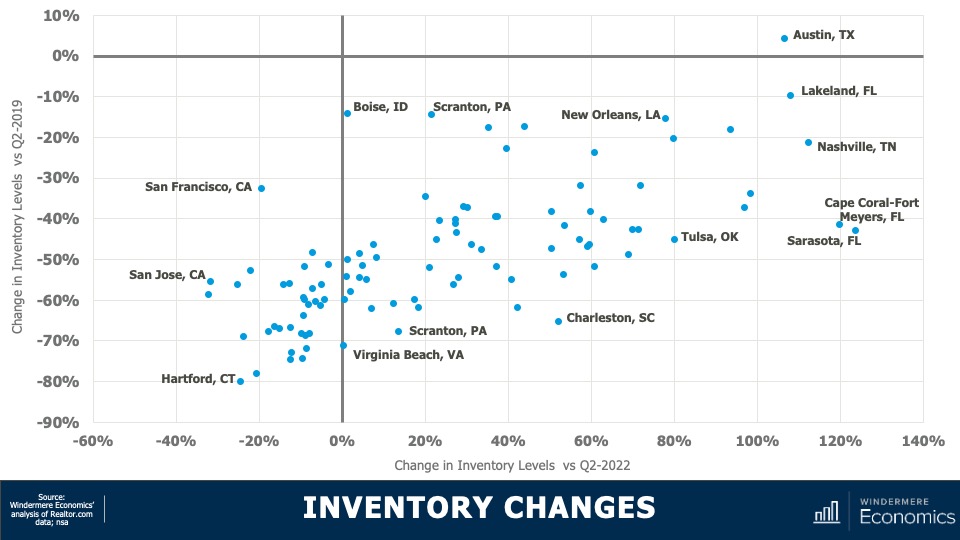

This chart shows how supply levels have changed. The data here is representative of the 100 largest metropolitan areas in the country. The horizontal axis shows the change in inventory versus the second quarter of 2022, while the vertical axis shows the difference and the number of homes for sale versus the second quarter of 2019. I think you’ll agree that the difference is stark. Although two-thirds of the metropolitan areas have seen the number of homes for sale improved versus the same period a year ago, just one (Austin, TX) had more homes for sale higher in the second quarter of this year than it had in the second quarter of 2019.

Interestingly, on a percentage basis, smaller metro areas saw the greatest decline compared to three years ago. For example, in Hartford, CT, the average number of homes on the market in the second quarter was just over 900, down by 80% from the second quarter of 2019 where there was an average of over 4,400 units for sale. Supply levels were down by 78% in Stamford, CT; 75% in New Haven, CT; and 74% in Allentown, PA.

It is true that supply levels are generally higher when compared to a year ago, with the greatest increase being seen in select markets in Florida, Tennessee, Texas, and Oklahoma; however, other than in Austin, supply levels remain well below their long-term averages. So, how is the market adapting? The answer is rather interesting. Even with all the talk of escalating material, land, and labor costs, it’s the new home industry that has been taking advantage of the lack of housing supply.

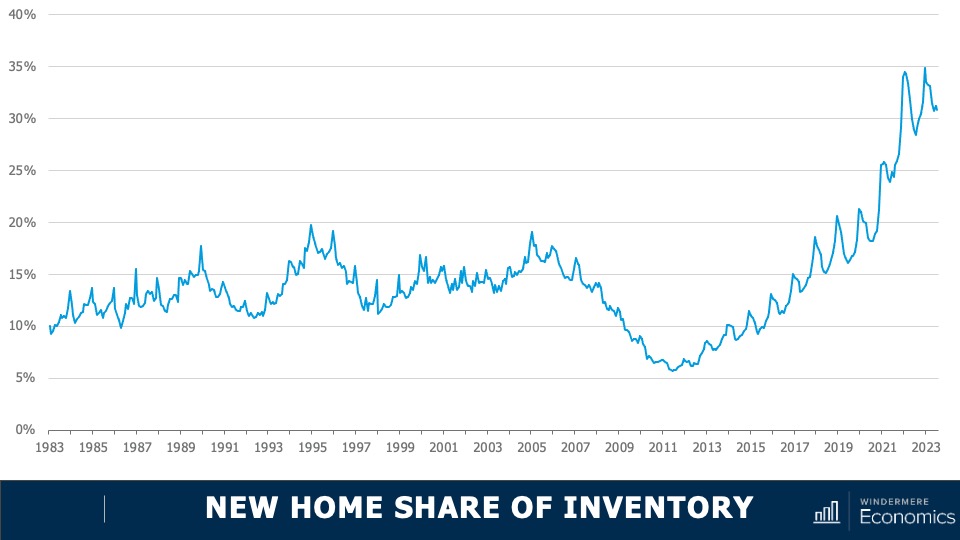

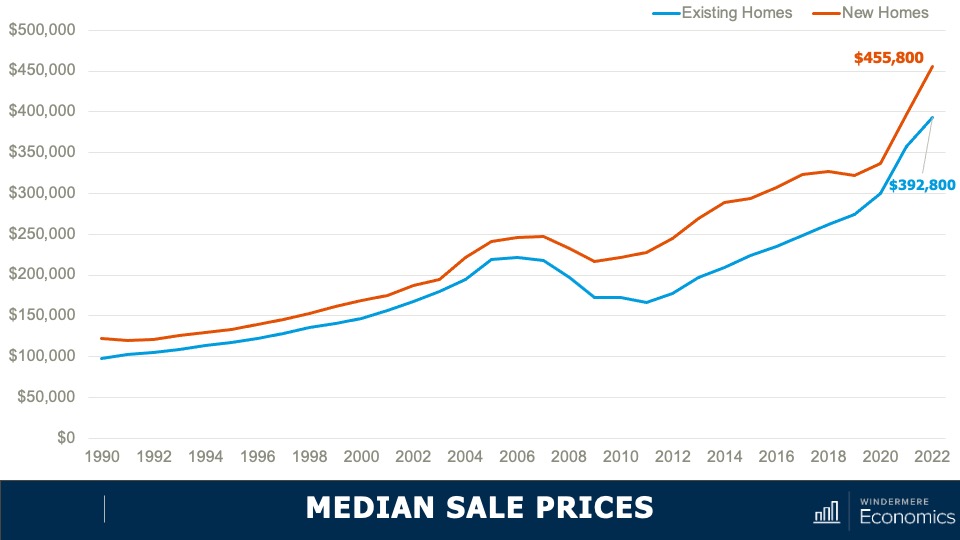

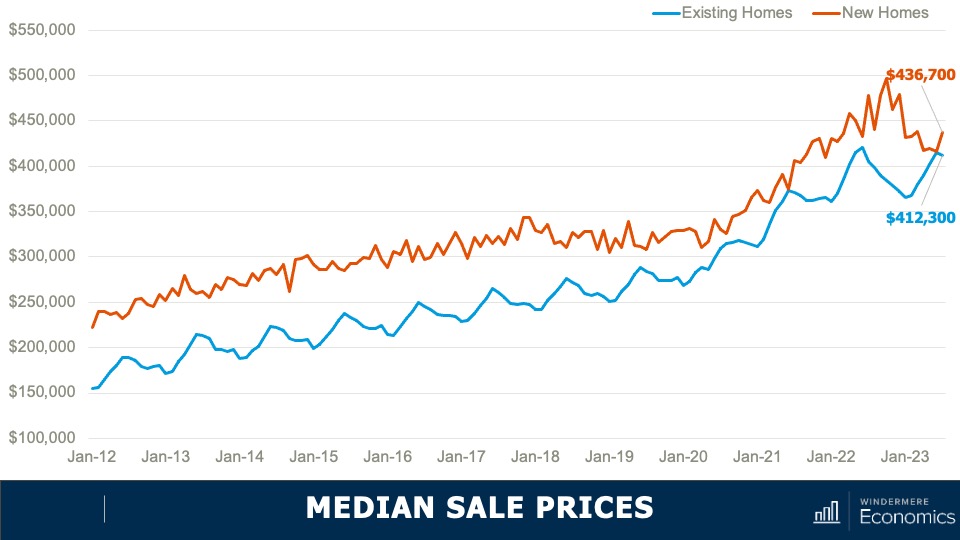

This chart shows the share of new homes on the market compared to their resale counterparts—here we are just looking at single-family homes. Historically, new construction makes up roughly 10% of active listings at any one time, but as you can see here, that share has been rising not just since the end of the pandemic but for the past several years. Although off the high seen a few months ago, 30% of the single-family homes for sale this July were brand new. I find this particularly interesting because, historically speaking, a premium was paid in order to buy a new home rather than an existing one.

With the share of new homes for sale holding at a four-decade high, the share of sales themselves is at a level we haven’t seen since 2005. But even though we know that there is demand for housing, shouldn’t sales be constrained by mortgage rates? Well, what is happening is that builders are attracting buyers through incentives, and here we’re talking about mortgage rate buydowns which are becoming increasingly prevalent across the country.

In fact, a recent survey from John Burns Consulting suggested that 30% of home builders reported using interest buydowns more in the second quarter of this year than they had previously. And this is attracting buyers to visit new development communities.

An example of these buydowns is the 2/1 program that DR Horton—the largest home builder in the country—is offering at some communities. This program gives buyers a mortgage rate that starts at 3% for the first year, rises to 4% in year two, and then goes to 5% for the balance of the 30-year term. That’s pretty compelling, given where mortgage rates are today.

The bottom line is that as far as I can see, the new home industry will continue to take an outsized share of the market for the balance of 2023 and likely through most of 2024. That said, once the market starts to normalize, I expect them to pull back from these incentive programs, making them more likely to start raising asking prices, and we will return to the traditional spread between the prices of new and resale homes.

Although it’s pleasing to see more homes being built, I still believe that the country will still be running a housing deficit when it comes to meeting demographic demand and this will continue to hurt first-time buyers who continue to be priced out of the market.

As always, I’d love to hear your thoughts on this subject so feel free to leave your comments below. Until next month, stay safe out there and I’ll see you soon. Bye now.

To see the latest real estate market data for your area, visit our Market Update page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Check out 1572 Sepia Avenue, a beautiful end unit townhome at Sienna Park! The open floor plan on the main level is great for entertaining and the extra windows let in lots of natural light. The kitchen features plenty of counter space with an island and a pantry for extra storage. Upstairs, you’ll find 3 large bedrooms, the primary and 2 additional large rooms. The primary bedroom features its own attached bathroom with shower and tub, and a large closet for storage. The laundry room is also conveniently located on the 2nd floor, across from the other full bathroom. An attached 2 car garage means you won’t have to fight for parking or clean snow off your car! Call (719) 310-9336 to schedule a private tour or click here for more information.

There’s nothing more exciting, rewarding, and fulfilling than buying or selling a home. However, it’s a complex transaction, and there are a number of steps along the path that can confuse even the most seasoned buyers and sellers. How can you avoid potential selling pitfalls and common buying mistakes? Look to your real estate agent for advice and keep the following guidelines in mind.

Review your credit report a few months before you begin searching for homes. You’ll have time to ensure the facts are correct and be able to dispute mistakes before your mortgage lender checks your credit. Get a copy of your credit report from Experian, Equifax, and TransUnion. Why all three? Because, if the scores differ, the bank will typically use the lowest one. Alert the credit bureaus if you see any mistakes, fix any problems you discover, and don’t apply for any new credit until after your home loan closes.

Before getting serious about your hunt for a new house, you’ll want to choose a lender and get pre-approved for a mortgage (not just pre-qualified—which is a cursory review of your finances—but pre-approved for a loan of a specific amount). Pre-approval lets sellers know you’re serious. Most importantly, pre-approval will help you determine exactly how much you can comfortably afford to spend.

You and your real estate agent should both be clear about the house you want to buy. Put it in writing. First, make a list of all the features and amenities you really want. Then, number each item and prioritize them. Now, divide the list into must-haves and nice-to-haves.

In addition to the purchase price of the home, there are additional costs you need to take into consideration, such as closing costs, appraisal fees, and escrow fees. Once you find a prospective home, you’ll want to:

Buying a home is emotionally charged—which can make it difficult for buyers to see the house for what it truly is. That’s why you need impartial third parties who can help you logically analyze the condition of the property. Your agent is there to advise you, but you also need a home inspector to assess any hidden flaws, structural damage, or faulty systems.

Image Source: Getty Images – Image Credit: svetikd

Once you decide to sell your house, it’s time to strip out the emotion and look at it as a commodity in a business transaction. If you start reminiscing about all the good times you had and the hard work you invested, it will only make it that much harder to successfully price, prepare, and market the home.

Homes with deferred maintenance and repair issues can take far longer to sell and can be subject to last-minute sale-cancellations. These homes also often sell for less than their legitimate market value. If you simply can’t afford to address critical issues, be prepared to work with your agent to price and market your home accordingly.

Getting top dollar is the dream of every seller. But it’s essential that you let the market dictate that price, not your emotions or financial situation. Allow your agent to research and prepare a market analysis that factors in the value of similar homes in the area and trust those results. Overpricing your home often spells trouble and can leave significant money on the table.

The vast majority of prospective buyers today search for homes online first. In order to make a good first impression, you need a wealth of high-quality photos of your home and surrounding grounds. It’s also critical that you stage your home to generate maximum buyer interest.

The process of buying or selling a home can have plenty of twists and turns, but with some smart decision making, you can avoid the most common mistakes and pitfalls. Lean on your agent for guidance throughout the process. Connect with a local Windermere agent to begin your buying or selling journey:

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years. According to a Harris Poll survey, 28% of homeowners have considered using a rental service to temporarily rent out their home for additional income.

Owning a short-term rental can be a tempting idea, but you may find the reality of being responsible for one difficult to take on. Here are some of the challenges you could face if you rent out your house instead of selling it.

Successfully owning and renting a house takes work. Think through your ability to make that commitment, especially if you plan to use a platform that advertises your rental listing. Most of them have specific requirements hosts have to meet, and it takes a lot of work. A recent article from Bankrate explains:

“Managing a rental property can be time-consuming and challenging. Are you handy and able to make some repairs yourself? If not, do you have a network of affordable contractors you can reach out to in a pinch? Consider whether you want to take on the added responsibility of being a landlord, which means screening tenants and fielding issues, among other responsibilities, or paying for a third party to take care of things instead.”

Not only is there the upfront time and cost of owning a short-term rental, but there are also risks that could come up for you down the road. Investopedia warns:

“Risks of hosting include renting your place to rude guests, theft or damaged property, complaints from neighbors, and potential regulatory violations depending on your location.”

There’s a lot to consider before taking the leap and converting your house into a short-term rental. If you aren’t ready for the work it takes, it could be wiser to sell instead.

Not every house ends up being a profitable short-term rental either. One of the biggest factors is where your home is located. The less likely your neighborhood is to be a travel destination, the fewer requests you should expect from potential renters—and that impacts your bottom line. An article from the National Association of Realtors (NAR) advises:

“When it comes to the viability of profitable STRs . . . consider factors like location, amenities, and whether the property is appealing. Most people seek STRs in locations where they vacation, so proximity to attractions is important. Likewise, the property should cater to a variety of travelers.”

It’s smart to do your homework and learn how much rentals in your area go for, how much business they get throughout the year, and how this compares to your goals.

Converting your home into a short-term rental isn’t a decision you should make without doing your research. To decide if selling your house is a better alternative, talk with a local real estate advisor today.

Thank you Keeping Current Matters for today’s content.

Welcome to 503 Eagle Crest Ct, a charming slice of Loveland nestled in a serene neighborhood just south of town. This meticulously maintained property boasts a spacious, open floorplan, flooded with natural light. Offering the perfect ambiance for entertaining or quiet evenings in. Upstairs is a true primary oasis. With a room large enough for a bed and sitting area, the primary bedroom is ready to be your new sanctuary. The primary bathroom features a large soaking tub to help you fully relax. In the walk-out basement you’ll find a rec room, additional living room, and dry bar. A private office with built-ins is ready for anyone who works from home or it can easily be converted into an additional bedroom. The highlight of the basement is the wine room! With racks waiting to be filled with your collection! The backyard is a true paradise for any outdoor lover. The patio features a built in grill and pergola with a hot tub. The 0.87 acre lot means you have space to play and privacy. This is truly a Loveland gem! Call (719) 310-9336 to schedule a private tour or click here for more information.